The financial system is changing so quickly that making sense of it is treacherous. Within a few months, the United States has gone from no jobs and depressed costs to widespread labor shortages and uncomfortable inflation levels.

Labor

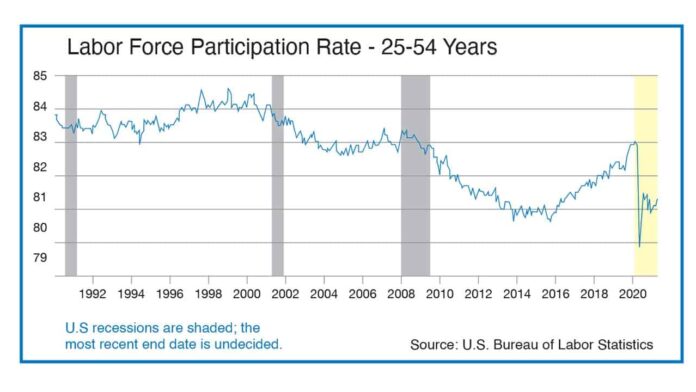

One of the most common concerns we are hearing from business owners is that they would like to expand, or merely recover, but can’t find labor to get back up to speed. Labor rates are going higher to try to entice more workers to re-enter the workforce.

The number of working-age Americans who are employed has declined in recent decades. As a result, there is a pool of would-be workers, sitting on the sidelines of the labor market. In April, the share of U.S. workers leaving jobs was 2.7%, according to the U.S. Labor Department, a jump from 1.6% a year earlier to the highest level since at least 2000 (See chart below). This indicates many professionals are feeling confident about leaving for better opportunities.

One of the few ways to have a true labor shortage in a capitalist economy is for workers to demand wages so high that businesses cannot stay afloat. However, there is a lot of evidence to suggest that the U.S. economy does not suffer from that problem.

“You look at the current timeframe and look a year and two ahead — we’re going to have a very, very strong labor market, and rising wages for people across the spectrum,” said Federal Reserve Chairman Jerome Powell, describing an environment of low joblessness and high employment rates.

Inflation

Those who have historically predicted that problematic inflation was imminent have been incorrect. One reason to be skeptical about dire inflation warnings is that economists have repeatedly overestimated the risks of inflation in the 21st century. A measure of this is contained in projected growth over the past decade relative to what occurred, as shown on page 20.

However, if inflation remains elevated for months, it could feed on itself. Companies would increase prices to cover the higher cost of raw materials. Workers would ask for wage increases to maintain their buying power. The Federal Reserve might then need to raise interest rates to prevent an inflationary spiral, and rapid rate increases have caused recessions in the past.

There are reasons to believe that inflation will be contained. Some companies have responded to higher prices, and to the opportunity to make higher profits, by increasing output. For example, lumber prices, after rising sharply, are now falling. The coming end to federal stimulus will also serve to reduce demand. The decline in government spending will act as a drag on economic growth and help hold down inflation.

Keys to watch

Stimulus. Will the COVID-19 federal stimulus payments stay in savings or be spent? Spending on short-term consumption may give us an unsustainable “sugar high.” Saving and spending over a longer period could provide a more stable path forward.

New Government spending may provide winners, losers and an uneven recovery. The trick is to spend money in areas that have high multiplier effects (example: $1 spent generates $6 of economic activity) rather than on lower impact areas.

Labor resolution. Globalization can be an offset to local labor shortages. However, when we look at the devastation COVID-19 is wreaking on India and Brazil, it is much less certain that they, and other emerging economies, can pick up the slack. Moreover, if labor rates rise without productivity increases, how will the economy react to lower profit levels and continued supply shortages?

COVID-19. The rest of the world has much lower vaccination rates than the U.S. What is the risk of unvaccinated workers here and abroad being sidelined by COVID? In a global supply economy, what is the risk of entire economies in the developing world experiencing slowdowns or shutdowns due to an inability to produce?

Food insecurity

Emerging evidence continues to confirm the effects of COVID-19 on food insecurity that are expected to continue through 2021 and 2022, according to the World Bank. An increasing number of countries are facing growing levels of acute food insecurity, reversing years of development gains.

Stresses on businesses and economies will be great as the financial system transitions.

Maurie Cashman is a member-owner of Agri-Management Farm Services LLC and manages its Aspen Grove Investments brand.

This appeared in the June 28 addition of the Corridor Business Journal

Residential Real Estate

Residential Real Estate