Business Valuation

Growthland provides independent, objective and defensible valuations for a variety of business purposes. Our clients recognize us as experts in providing valuations for

- Absorption Discounts

- Business Acquisitions and Sales

- Charitable Remainder Trusts (CRTS)

- Grantor Retained Annuity Trusts (GRATs)

- Minority Shareholder Discounts

- Shareholder Disputes

- Tax Planning

- Bank Loan Support

- Buy-Sell Agreements

- Estate Planning

- Insurance Personal Goodwill

- Stock Incentive Plans

in these and other industries:

- Agricultural Equipment Manufacturing

- Beverage Distribution

- Construction

- Farm Limited Partnerships

- Food Processing

- Food Service

- Industrial Parts Sourcing

- Landscaping Supplies and Services

- Manufacturing

- Medical Regulatory Compliance

- Printing

- Retail

- Transportation

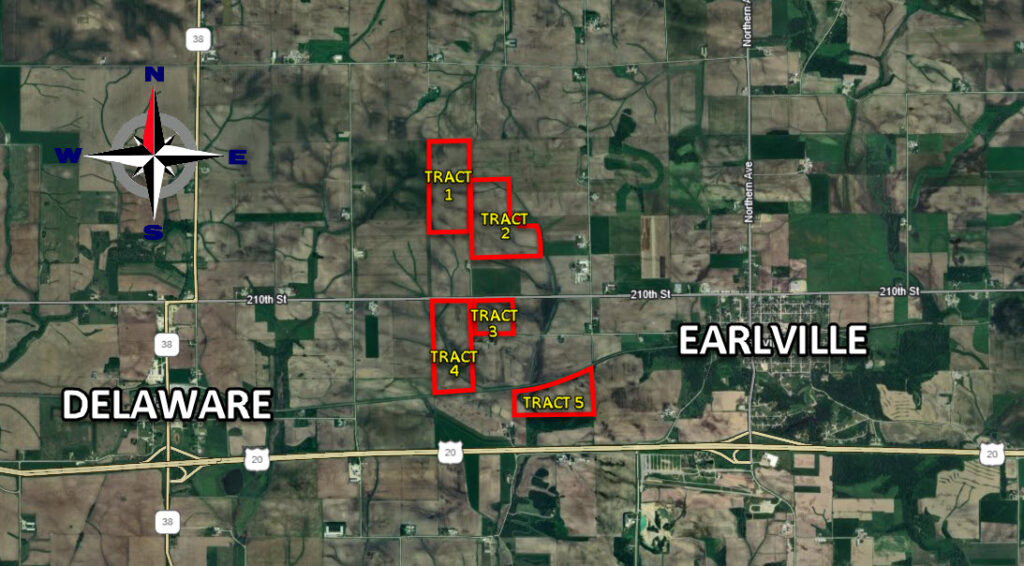

- Agricultural Real Estate and Management

- Commercial Greenhouses

- Entertainment

- Financial Services

- Feed Manufacturing

- Franchising

- Internet Equipment Wholesale

- Legal

- Medical Providers

- Office Furnishings and Supply

- Restaurant Equipment Supply

- Telecommunications

- Wholesale Distribution

Understanding valuation is fundamental to what we do at Growthland. It informs our Mergers & Acquisitions representation and Ownership Transition Planning. Contact us today to get started in better understanding…

How Growthland Can Help You

Many business owners believe the value of their business is net profit, or gross sales, multiplied by an industry rule of thumb. This is simply not the case. In fact, the application of an industry rule of thumb formula often results in a value determination that differs greatly from the actual value that we would determine.

Accurate Value Determination

The result of an inaccurate value determination, regardless of whether it is high or low, generally leads to undesirable consequences. For instance, if the value is too high, estate taxes will be too high; savvy investors or prospective buyers will usually disregard a value that appears too high. If the value is too low, you can be sure savvy investors or prospective buyers will recognize it and take advantage. Likewise, if you are on the other side of the dispute in a dissenting shareholder action or divorce, you certainly want to know you are receiving an accurate value for your interest.

Careful Analysis

Determining the true value of a business enterprise requires a careful analysis of two primary components that make up value: tangible assets such as real estate, machinery, and furniture used by the business; and various intangible assets such as business or personal goodwill. Intangible assets might also include customer lists, trademarks, copyrights, distribution rights, a superior management team, non-compete agreements, physical location, special processes, and name recognition.

Understanding the Business

To properly value a business enterprise, we’ll acquire a thorough understanding of every aspect of a company’s dynamics, including: management capabilities, company strengths, weaknesses and vulnerabilities, the competitive environment, overall expectations for the marketplace, and future economic prospects for the industry and the economy in the region and as a whole. All of these elements affect the risk of ownership in a particular enterprise, and risk directly impacts value. Additionally, we analyze the inherent financial health of the enterprise and its future profit potential.

Sorting Through a Complex Process

After a thorough analysis of all the company’s dynamics and its financial health, we’ll select the most appropriate methodology from among the many accepted by the valuation industry, and apply a series of calculations and formulas to arrive at the ultimate conclusion of value. Overall, the process is highly complex and requires a significant amount of time. Indeed, this is what is required to determine the true economic value of a privately owned business enterprise, and this is what Growthland brings to your table.

We hold the designation of Certified Valuation Analyst (CVA), awarded by the National Association of Certified Valuation Analysts (NACVA)

Residential Real Estate

Residential Real Estate